Që nga fundi i qershorit, çmimi i stirenit ka vazhduar të rritet me gati 940 juanë/ton, duke ndryshuar rënien e vazhdueshme në tremujorin e dytë, duke i detyruar ekspertët e industrisë që shesin stiren në mënyrë të shkurtër të ulin pozicionet e tyre. A do të bjerë përsëri rritja e ofertës nën pritjet në gusht? Nëse kërkesa për Jinjiu mund të publikohet paraprakisht është arsyeja kryesore për të përcaktuar nëse çmimi i stirenit mund të vazhdojë të jetë i fortë.

Ekzistojnë tre arsye kryesore për rritjen e çmimeve të stirenit në korrik: së pari, rritja e qëndrueshme e çmimeve ndërkombëtare të naftës ka çuar në një përmirësim të ndjesisë makroekonomike; Së dyti, rritja e furnizimit është më e ulët se sa pritej, duke rezultuar në një rënie të prodhimit të stirenit, vonesë në rinisjen e pajisjeve të mirëmbajtjes dhe mbyllje të paplanifikuar të pajisjeve të prodhimit; Së treti, kërkesa për eksporte të paplanifikuara është rritur.

Çmimet ndërkombëtare të naftës vazhdojnë të rriten dhe atmosfera makroekonomike përmirësohet

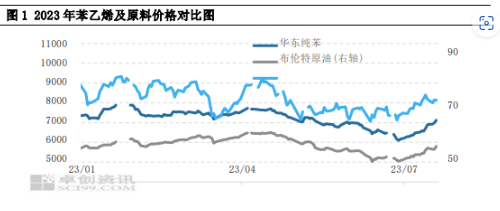

Në korrik të këtij viti, çmimet ndërkombëtare të naftës filluan të rriten, me një rritje të ndjeshme në dhjetë ditët e para dhe më pas duke luhatur në nivele të larta. Arsyet për rritjen e çmimeve ndërkombëtare të naftës përfshijnë: 1. Arabia Saudite zgjati vullnetarisht uljen e prodhimit dhe dërgoi një sinjal në treg për të stabilizuar tregun e naftës; 2. Të dhënat e inflacionit në SHBA për IÇK-në janë më të ulëta se pritjet e tregut, duke çuar në një dollar amerikan të dobët. Pritjet e tregut që Rezerva Federale të rrisë normat e interesit këtë vit janë ulur dhe pritet të vazhdojë të rrisë normat e interesit në korrik, por mund të ndalet në shtator. Në sfondin e rritjes së ngadaltë të normave të interesit dhe një dollari amerikan të dobët, oreksi për rrezik në tregun e mallrave është rikthyer dhe nafta bruto vazhdon të rritet. Rritja e çmimeve ndërkombëtare të naftës ka rritur çmimin e benzenit të pastër. Edhe pse rritja e çmimeve të stirenit në korrik nuk u nxit nga benzeni i pastër, ajo nuk e zvogëloi rritjen e çmimeve të stirenit. Nga Figura 1, mund të shihet se tendenca rritëse e benzenit të pastër nuk është aq e mirë sa ajo e stirenit dhe fitimi i stirenit vazhdon të përmirësohet.

Përveç kësaj, atmosfera makro ka ndryshuar gjithashtu këtë muaj, me publikimin e ardhshëm të dokumenteve përkatëse për të nxitur konsumin duke rritur ndjesinë e tregut. Tregu pritet të ketë politika përkatëse në Konferencën Ekonomike të Byrosë Politike Qendrore në korrik, dhe operacioni është i kujdesshëm.

Rritja e furnizimit me stiren është më e ulët se sa pritej, dhe inventari i portit është ulur në vend që të rritet.

Kur parashikohet bilanci i ofertës dhe kërkesës për korrikun në qershor, pritet që prodhimi vendas në korrik të jetë rreth 1.38 milion ton, dhe inventari kumulativ shoqëror do të jetë rreth 50000 ton. Megjithatë, ndryshimet e paplanifikuara rezultuan në një rritje më të ulët se sa pritej në prodhimin e stirenit, dhe në vend të një rritjeje në inventarin kryesor të portit, ai u ul.

1. Të ndikuara nga faktorë objektivë, çmimet e materialeve të përzierjes që lidhen me toluenin dhe ksilenin janë rritur me shpejtësi, veçanërisht vaji i alkiluar dhe hidrokarburet aromatike të përziera, të cilat kanë nxitur rritjen e kërkesës së brendshme për përzierjen e toluenit dhe ksilenit, duke rezultuar në një rritje të fortë të çmimeve. Prandaj, çmimi i etilbenzenit është rritur përkatësisht. Për ndërmarrjet e prodhimit të stirenit, efikasiteti i prodhimit të etilbenzenit pa dehidrogjenizim është më i mirë se rendimenti i dehidrogjenizimit të stirenit, duke rezultuar në një rënie në prodhimin e stirenit. Kuptohet që kostoja e dehidrogjenizimit është afërsisht 400-500 juanë/ton. Kur diferenca e çmimit midis stirenit dhe etilbenzenit është më e madhe se 400-500 juanë/ton, prodhimi i stirenit është më i mirë dhe anasjelltas. Në korrik, për shkak të një rënieje në prodhimin e etilbenzenit, prodhimi i stirenit ishte afërsisht 80-90000 ton, gjë që është gjithashtu një arsye pse inventari kryesor i portit nuk u rrit.

2. Mirëmbajtja e njësive të stirenit është relativisht e përqendruar nga maji deri në qershor. Plani fillestar ishte të rifillohej në korrik, me pjesën më të madhe të tij të përqendruar në mesin e korrikut. Megjithatë, për shkak të disa arsyeve objektive, shumica e pajisjeve vonohen në rifillimin e tyre; Ngarkesa e pajisjes së re është më e ulët se sa pritej dhe ngarkesa mbetet në një nivel mesatar deri të ulët. Përveç kësaj, impiantet e stirenit si Tianjin Dagu dhe Hainan Refining and Chemical kanë gjithashtu mbyllje të paplanifikuara, duke shkaktuar humbje në prodhimin vendas.

Pajisjet e huaja mbyllen, duke çuar në një rritje të kërkesës së planifikuar të Kinës për eksport stiren.

Në mesin e këtij muaji, fabrika e stirenit në Shtetet e Bashkuara ishte planifikuar të ndërpriste funksionimin, ndërsa mirëmbajtja e fabrikës në Evropë ishte planifikuar. Çmimet u rritën me shpejtësi, dritarja e arbitrazhit u hap dhe kërkesa për arbitrazh u rrit. Tregtarët morën pjesë aktive në negociata dhe tashmë kishte transaksione eksporti. Në dy javët e fundit, vëllimi total i transaksioneve të eksportit ka qenë rreth 29000 ton, kryesisht të instaluara në gusht, kryesisht në Korenë e Jugut. Megjithëse mallrat kineze nuk u dorëzuan direkt në Evropë, pas optimizimit të logjistikës, vendosja e mallrave në mënyrë indirekte mbushi boshllëkun në drejtimin evropian dhe iu kushtua vëmendje nëse transaksionet mund të vazhdonin në të ardhmen. Aktualisht, kuptohet që prodhimi i pajisjeve në Shtetet e Bashkuara do të ndërpritet ose do të kthehet në fund të korrikut.dhe në fillim të gushtit, ndërsa afërsisht 2 milionë ton pajisje në Evropë do të ndërpriten në fazat e mëvonshme. Nëse ata vazhdojnë të importojnë nga Kina, ato mund të kompensojnë kryesisht rritjen e prodhimit vendas.

Situata në rrjedhën e poshtme nuk është optimiste, por nuk ka arritur një nivel reagimi negativ.

Aktualisht, përveç përqendrimit në eksporte, industria e tregut beson gjithashtu se reagimet negative nga kërkesa në rrjedhën e poshtme janë çelësi për përcaktimin e çmimit maksimal të stirenit. Tre faktorët kryesorë në përcaktimin nëse reagimet negative në rrjedhën e poshtme ndikojnë në mbylljen/reduktimin e ngarkesës së ndërmarrjeve janë: 1. nëse fitimet në rrjedhën e poshtme janë me humbje; 2. A ka ndonjë porosi në rrjedhën e poshtme; 3. A është inventari në rrjedhën e poshtme i lartë. Aktualisht, fitimet e EPS/PS në rrjedhën e poshtme kanë humbur para, por humbjet në dy vitet e fundit janë ende të pranueshme, dhe industria ABS ende ka fitime. Aktualisht, inventari i PS është në një nivel të ulët dhe porositë janë ende të pranueshme; rritja e inventarit të EPS është e ngadaltë, me disa kompani që kanë inventar më të lartë dhe porosi më të dobëta. Në përmbledhje, megjithëse situata në rrjedhën e poshtme nuk është optimiste, ajo ende nuk ka arritur nivelin e reagimeve negative.

Kuptohet që disa terminale ende kanë pritshmëri të mira për Double Eleven dhe Double Twelve, dhe plani i planifikimit të prodhimit për fabrikat e pajisjeve shtëpiake në shtator pritet të rritet. Prandaj, ende ka çmime të forta nën rimbushjen e pritur në fund të gushtit. Ekzistojnë dy situata:

1. Nëse stireni rimëkëmbet para mesit të gushtit, pritet një rimëkëmbje e çmimeve deri në fund të muajit;

2. Nëse stireni nuk rimëkëmbet para mesit të gushtit dhe vazhdon të forcohet, rimbushja e stokut në terminal mund të vonohet dhe çmimet mund të dobësohen në fund të muajit.

Koha e postimit: 25 korrik 2023