Në gjysmën e parë të vitit 2022, performanca e përgjithshme eizopropanolTregu nuk ishte i kënaqshëm. Disa kapacitete të reja janë liruar, por krahasuar me vitin e kaluar, disa kapacitete janë eliminuar dhe kapaciteti mbetet i qëndrueshëm, por presioni i ofertës dhe kërkesës mbetet i pandryshuar. Presioni i inventarit në disa fabrika është ende i varur nga lehtësimi i kërkesës për eksport, dhe çmimet e tregut kanë qenë kryesisht në nivele të ulëta deri në të mesme me amplitudë të kufizuar në vitet e fundit.

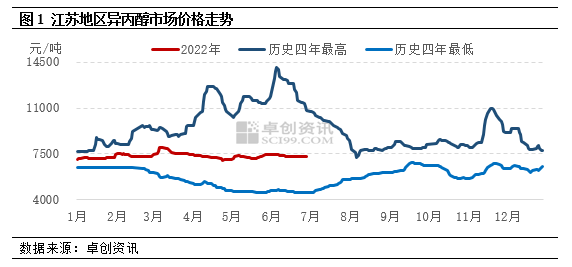

Në gjysmën e parë të vitit 2022, tregu i përgjithshëm i izopropanolit ishte në një nivel të ulët deri të mesëm. Në tregun e Jiangsu-s, për shembull, çmimi mesatar i tregut në gjysmën e parë të vitit ishte 7,343 juanë/ton, duke u rritur me 0,62% në krahasim me të njëjtën periudhë të vitit të kaluar dhe duke rënë me 11,17% në krahasim me të njëjtën periudhë të vitit të kaluar. Midis tyre, çmimi më i lartë prej 8,000 juan/ton, i cili u shfaq në mesin e marsit, ishte 0,29%, ndërsa çmimi më i ulët prej 7,000 juan/ton, i cili u shfaq në prill, ishte 0,29%.

Amplitudë e kufizuar e luhatjeve të intervalit

Në gjysmën e parë të vitit 2022, tregu i izopropanolit tregoi në thelb një tendencë fillimisht lart e më pas poshtë, por hapësira e luhatjes ishte relativisht e kufizuar. Nga janari deri në mars, tregu i izopropanolit luhati lart. Në fillim të Festës së Pranverës, aktivitetet tregtare të tregut u ulën gradualisht dhe shumica e segmenteve të blerjes dhe shitjes ishin në një gjendje pritjeje, dhe çmimi i tregut luhatej në thelb në rangun 7050-7250 juan/ton; pas Festës së Pranverës, tregu i lëndëve të para të acetonit dhe propilenit u rrit në shkallë të ndryshme, duke nxitur entuziazmin e fabrikave të izopropanolit. Qendra e gravitetit të negociatave në tregun vendas të alkoolit izopropilik u rrit shpejt në 7,500-7,550 juan/ton, por për shkak të rimëkëmbjes së ngadaltë të kërkesës terminale, tregu ra gradualisht në 7,250-7,300 juan/ton; Kërkesa për eksport në mars është e fortë, disa fabrika të alkoolit izopropilik që eksportojnë porte të mbivendosura mbi çmimet e ardhshme të naftës bruto WTI tejkaluan shpejt 120 dollarë për fuçi, fabrikat e alkoolit izopropilik dhe ofertat e tregut vazhdojnë të përmirësohen. Sipas mentalitetit të blerjes në rrjedhën e poshtme, qëllimi i blerjes u rrit. Deri në mesin e marsit, tregu ishte rritur në një nivel të lartë prej 7,900-8,000 juan/ton. Tregu i izopropanolit ra nga marsi deri në fund të prillit. Nga njëra anë, në mars, fabrika e izopropanolit e Ningbo Juhua prodhoi me sukses për eksport dhe ekuilibri i ofertës dhe kërkesës së tregut u prish përsëri. Nga ana tjetër, në prill, kapaciteti logjistik në rajon u ul, duke çuar në një tkurrje graduale të kërkesës së tregtisë së brendshme. Pothuajse në prill, çmimi i tregut ra në një nivel të ulët prej 7,000-7,100 juan/ton. Maj-qershor, tregu i izopropanolit u dominua nga luhatje të ngushta. Pasi çmimi vazhdoi të binte në prill, disa njësi vendase të izopropanolit u përqendruan në parkim dhe mirëmbajtje, dhe tregu u shtrëngua me çmime të ulëta, por kërkesa vendase mbeti e pandryshuar. Pas përfundimit të përgatitjeve për eksport, impulsi i çmimeve të tregut nuk është i mjaftueshëm. Në këtë fazë, diapazoni kryesor operativ i tregut është 7,200-7,400 juanë/ton.

Trendi në rritje i furnizimit total është i dukshëm, dhe kërkesa për eksport është rritur gjithashtu.

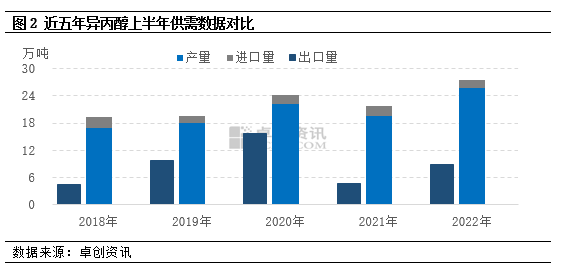

Për sa i përket prodhimit vendas, njësia e izopropanolit prej 50,000 t/a e Ningbo Juhua u prodhua dhe u eksportua me sukses në mars, por në të njëjtën kohë, njësia e izopropanolit prej 50,000 t/a e Dongying Haike u çmontua. Sipas metodës informative Zhuo Chuang, ajo u hoq nga kapaciteti i prodhimit të izopropanolit, në mënyrë që kapaciteti vendas i prodhimit të izopropanolit të mbetej i qëndrueshëm në 115.80,000 ton. Për sa i përket prodhimit, kërkesa për eksport në gjysmën e parë të vitit ishte në rregull dhe prodhimi ishte në një trend rritës. Sipas statistikave informative të Zhuo Chuang, në gjysmën e parë të vitit 2022, prodhimi i izopropanolit në Kinë është rreth 25.59 milionë ton, një rritje prej 60,000 ton ose 30.63%.

Importet: Importet janë në një trend rënës për shkak të rritjes së furnizimit vendas dhe ofertës e kërkesës së tepërt vendase. Nga janari deri në qershor 2022, Kina importoi gjithsej rreth 19.3 mijë ton izopropanol, një rënie prej 22 mijë ton, një rënie prej 10.23%.

Eksportet: Nuk ka rënie të presionit të furnizimit vendas dhe presioni i inventarit në disa fabrika varet ende nga lehtësimi i kërkesës për eksport. Nga janari deri në qershor 2022, eksportet totale të izopropanolit të Kinës ishin rreth 89,300 ton, duke u rritur me 40,000 ton, 210,000 ton, ose 89.05%.

Fitimi bruto i procesit të dyfishtë dhe divergjenca e prodhimit

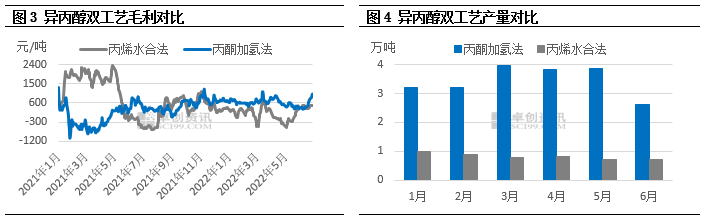

Sipas llogaritjeve të modelit të fitimit bruto teorik të alkoolit izopropilik, në gjysmën e parë të vitit 2022, fitimi bruto teorik i procesit të hidrogjenizimit të alkoolit izopropilik me aceton ishte 603 juan/ton, më i lartë se e njëjta periudhë e vitit të kaluar prej 630 juan/ton, një rritje prej 2333.33%; fitimi bruto teorik i procesit të hidratimit të propilenit me alkool izopropilik ishte 120 juan/ton, më i ulët se e njëjta periudhë e vitit të kaluar prej 1138 juan/ton, një rënie prej 90%.46%. Nga grafiku krahasues i fitimit bruto të procesit të dyfishtë të alkoolit izopropilik, mund të shihet se në vitin 2022, teoria e alkoolit izopropilik me dy procese të fitimit bruto është ndarë, niveli i fitimit bruto i teorisë së procesit të hidrogjenizimit të acetonit është i qëndrueshëm, fitimi mesatar mujor luhatet në thelb midis 500-700 juan/ton, por humbja e fitimit bruto të teorisë së procesit të hidratimit të propilenit ishte gati 600 juan/ton. Krahasuar me fitimin bruto të këtyre dy proceseve, fitimi i procesit të hidrogjenizimit me aceton alkooli izopropilik është aktualisht më i mirë se ai i ujit të propilenit.

Nga të dhënat e kërkesës për prodhimin e alkoolit izopropilik në vitet e fundit, shkalla e rritjes së kërkesës së brendshme nuk ka mbajtur ritmin me zgjerimin e kapacitetit të prodhimit. Në situatën e mbifurnizimit afatgjatë, niveli teorik i rentabilitetit të impianteve të izopropanolit është bërë një faktor kyç në përcaktimin e nivelit të fillimit. Në vitin 2022, fitimi bruto i procesit të hidrogjenizimit të izopropanolit vazhdon të tejkalojë atë të ujit të propilenit, duke e bërë prodhimin e impiantit të procesit të hidrogjenizimit të izopropanolit shumë më të lartë se uji i propilenit. Sipas monitorimit të të dhënave të informacionit të Zhuo Chuang: në gjysmën e parë të vitit 2022, prodhimi i izopropanolit përbënte rreth 80% të prodhimit të përgjithshëm kombëtar. 73%.

Fokusimi në trendet e kostos dhe kërkesën për eksport në gjysmën e dytë të vitit

Në gjysmën e dytë të vitit 2022, nga bazat e ofertës dhe kërkesës, nuk ka njësi të reja izopropanoli në treg, kapaciteti vendas i prodhimit të izopropanolit do të mbetet në 1.158 milion ton, dhe prodhimi vendas dominohet ende nga procesi i hidrogjenizimit të acetonit. Me rritjen e rrezikut të stagflacionit në ekonominë globale, kërkesa e eksportit për izopropanol është dobësuar. Në të njëjtën kohë, kërkesa vendase e terminalit është e ngadaltë në rikuperim, ose "sezoni i pikut nuk është i begatë" në gjysmën e dytë të vitit, presioni i ofertës dhe kërkesës ende nuk është ulur. Nga pikëpamja e kostos, duke marrë parasysh disa pajisje të reja fenolike në gjysmën e dytë të këtij viti, mbifurnizimi i tregut të acetonit, skaji i sipërm i çmimeve të lëndës së parë të acetonit do të vazhdojë të ketë ndikim të ulët; gjysma e dytë e këtij viti, ndikimi i politikës së rritjes së normës së interesit të Rezervës Federale dhe rreziku i recesionit në Evropë dhe Shtetet e Bashkuara, fokusi i çmimeve ndërkombëtare të naftës mund të bjerë. Ana e kostos është faktori kryesor që ndikon në çmimet e propilenit, çmimet e tregut të propilenit do të ulen krahasuar me gjysmën e dytë të këtij viti. Në përgjithësi, presioni i kostos mbi ndërmarrjet e izopropanolit nuk është i rëndësishëm për momentin, dhe presioni i kostos mbi ndërmarrjet e izopropanolit të hidratit të propilenit pritet të lehtësohet, por në të njëjtën kohë, në mungesë të mbështetjes efektive të kostos, aftësia e tregut të izopropanolit për t'u rimëkëmbur është e pamjaftueshme. Tregu i alkoolit izopropilik pritet të ruajë një model luhatjeje të diapazonit në gjysmën e dytë të vitit, duke u përqendruar në tendencat e çmimeve të acetonit në rrjedhën e sipërme dhe ndryshimet në kërkesën për eksport.

Chemwinështë një kompani tregtare e lëndëve të para kimike në Kinë, e vendosur në Zonën e Re Pudong të Shangait, me një rrjet portesh, terminalesh, aeroportesh dhe transporti hekurudhor, si dhe me depo kimike dhe kimikatesh të rrezikshme në Shangai, Guangzhou, Jiangyin, Dalian dhe Ningbo Zhoushan, Kinë, ku ruhen më shumë se 50,000 ton lëndë të para kimike gjatë gjithë vitit, me furnizim të mjaftueshëm, mirëpresim blerjen dhe pyetjet tuaja. chemwinemail:service@skychemwin.comwhatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Koha e postimit: 24 gusht 2022